Frequently Asked Questions

Paying for medical care can be complicated. There are deductibles, copays, and often multiple bills. At the Mount Sinai Health System, we are here to help and make it as clear as possible. Below are some of the questions we hear most often about billing and insurance.

- Top FAQs

- Understanding My Bill

- Paying My Bill

- Online Account

- Insurance

- Financial Assistance

- Contact Information

Top FAQs

How can I find out whether a doctor at Mount Sinai Health System takes my insurance?

You should contact your doctor’s office directly to confirm whether your insurance is accepted. You can also check Mount Sinai’s Find a Doctor feature to find out whether a particular doctor accepts your insurance. You can learn more about the health plans our hospitals participate in by visiting our hospital Insurance Information page.

I have insurance, so why am I receiving a bill from Mount Sinai?

You are responsible for paying any costs that your insurance company does not cover, including items like your copay, deductible, and other non-covered charges. Unless prior arrangements were made, you receive a bill after the costs associated with your visit have been processed by your insurance company.

The amount you are billed is based on what your insurance communicates to us in an Explanation of Benefits (EOB). If you do not have insurance and believe you cannot afford to pay, consult our financial assistance policy.

I received an Explanation of Benefits (EOB). Why am I also receiving a bill from Mount Sinai?

Your EOB is different from your Mount Sinai bill. Your Explanation of Benefits summarizes the services you received, the associated costs, and how much your insurance carrier paid. You receive a bill from Mount Sinai after costs associated with your visit are processed by your insurance. You are responsible for paying any costs that your insurance company does not cover.

Your health insurer sends the EOB to help you track your expenses and the limits of your plan (e.g., your deductible, your out-of-pocket maximum, etc.).

Why does my Explanation of Benefits (EOB) not match my Mount Sinai bill?

There are several reasons why the amount you owe on your EOB might not match your Mount Sinai bill. Generally speaking, your EOB should match your bill, unless your insurance company does not cover certain services.

These can include, but are not limited to:

- Your EOB is combining several visits together, while Mount Sinai bills for each individual visit.

- You elected for a private room during your hospital stay that your insurance did not cover.

- You elected for cosmetic or other non-medical services that were not covered by your insurance carrier.

- Your insurance carrier did not cover the NYS Surcharge and you are responsible for paying this tax.

Please contact the customer service phone number on your bills if you have any questions.

What if I disagree with my balance or the charges on my statement?

We’re happy to speak with you about any billing details or questions you might have. Please contact the phone number listed on your bill to speak with our Customer Service team.

Why am I getting a bill from a physician I never saw?

You may receive bills from physicians you did not see in person if you have certain tests or treatments in the hospital. These bills are for the professional services doctors provided in diagnosing and interpreting test results while you were a patient.

If you were seen by pathologists, cardiologists, anesthesiologists, radiologists, emergency room doctors, or other specialists, they are required to submit separate bills. Please contact the phone number listed on your bill if you have any questions.

Why am I receiving multiple bills from Mount Sinai?

When you receive care at Mount Sinai, depending on the services rendered, you may receive more than one bill. For example, if you have a visit with one of our physicians and you also have blood drawn for lab tests, you may receive a bill from your physician and a separate bill from the lab. If you receive care at one of our hospitals, a physician office, or clinic located at one of our hospital sites, you may also receive more than one bill: one from the hospital and others from the doctors or specialists who treated you.

The hospital bills for charges related to services, supplies, equipment, or room used during your stay (this is known as the technical or facility bill). The physicians caring for you bill for charges related to their professional services and/or interpretation of tests (this is known as the professional bill).

You are receiving multiple bills because we are required to bill your insurance separately for professional and technical components of your care. Please contact the customer service phone number on your bills if you have any questions.

How can I pay my bill?

There are several convenient ways to pay Mount Sinai bills for yourself or someone else—the quickest and easiest is to pay online. You can start by searching your bill type on our patient billing portal for relevant contact information.

Online: To pay online, please look at the billing statement for an account number, Patient Account Access Number (PAAN), or other information you might need to log in. You can pay for yourself or someone else, such as a family member.

By phone: You can call us at the number on your billing statement to pay by phone. During normal business hours, you can speak with a customer service agent. For some of our sites, you can also pay over our 24/7 automated system.

By mail: You can mail in your payment with the payment stub to the appropriate location listed on your bill.

My insurance information or personal information has changed. How can I update you?

If your insurance or personal information is incorrect or not listed on your statement, please call the number listed on your billing statement. For some of our sites, you might also have the option to update your information through an online billing portal.

If I can't pay my bill, do you offer financial assistance?

Mount Sinai can help patients who have difficulty paying their hospital bills. To learn more about whether you qualify, consult our financial assistance policy.

If you have difficulty paying your physician bill, contact your physician’s office directly to learn about potential financial assistance policies they might have.

I need help understanding my bill.

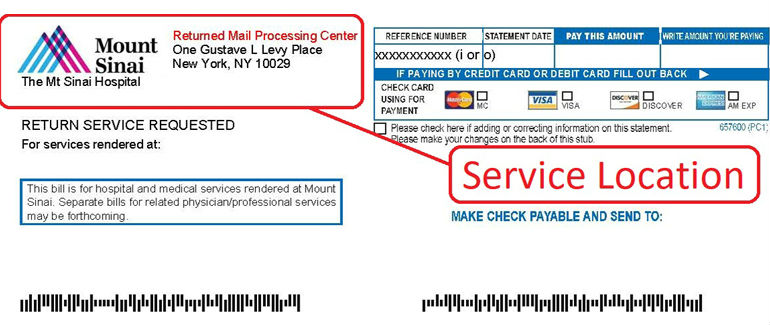

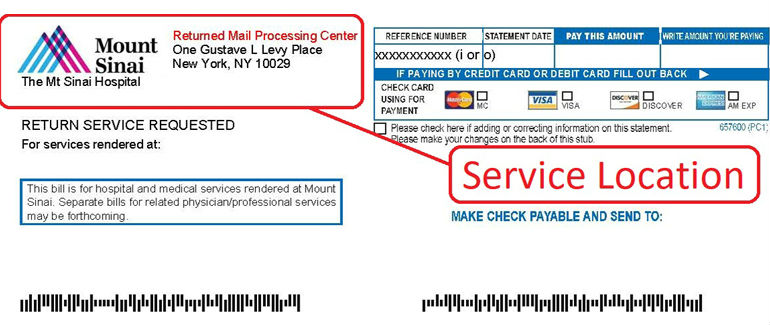

Finding Your Service Location:

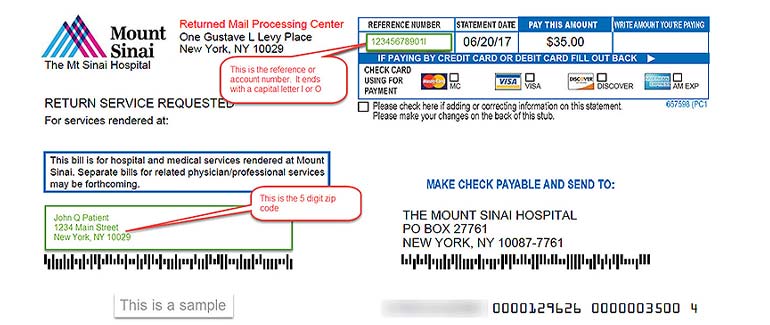

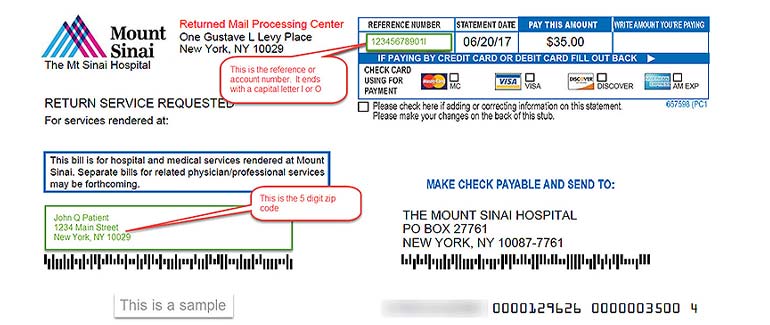

Finding Your Account Number:

Explaining key terms

The language associated with medical bills and insurance can be confusing. Here are some explanations of key terms to help you make sense of your bill.

A copay (short for copayment) is a fixed amount you pay for a covered healthcare service. Copays are a form of cost sharing between you and your insurer, and you might have different copay amounts for different services.

A deductible is a fixed-dollar amount that you need to pay before your insurer begins to cover your medical services. You normally pay a deductible during a given period of time (your “benefits period”), and afterwards, you usually pay only a copayment or coinsurance for covered services.

Coinsurance is the percentage of costs you pay for covered health care services after meeting your deductible. For example, let’s say your health insurance plan allowed $100 for an office visit and your coinsurance is 15 percent. If you’ve paid your deductible, you will pay 15 percent of $100, or $15. Generally, you will pay coinsurance until meeting your plan’s out-of-pocket maximum.

The “NYS Surcharge” you see on your bill is a tax on the hospital services that you receive. Under New York State’s Health Care Reform Act (HCRA), we are required to collect the surcharge and to pay it to New York State’s Department of Health. Some insurance carriers will pay the NY State Surcharge on your behalf, but this varies by insurance carrier. If your insurance carrier did not pay this tax or you do not have health care coverage, you are responsible for paying the NY State Surcharge and we are required to pay the collected surcharge to New York State.

Understanding My Bill

I need help understanding my bill.

Finding Your Service Location:

Finding Your Account Number:

Explaining key terms

The language associated with medical bills and insurance can be confusing. Here are some explanations of key terms to help you make sense of your bill.

A copay (short for copayment) is a fixed amount you pay for a covered healthcare service. Copays are a form of cost sharing between you and your insurer, and you might have different copay amounts for different services.

A deductible is a fixed-dollar amount that you need to pay before your insurer begins to cover your medical services. You normally pay a deductible during a given period of time (your “benefits period”), and afterwards, you usually pay only a copayment or coinsurance for covered services.

Coinsurance is the percentage of costs you pay for covered health care services after meeting your deductible. For example, let’s say your health insurance plan allowed $100 for an office visit and your coinsurance is 15 percent. If you’ve paid your deductible, you will pay 15 percent of $100, or $15. Generally, you will pay coinsurance until meeting your plan’s out-of-pocket maximum.

The “NYS Surcharge” you see on your bill is a tax on the hospital services that you receive. Under New York State’s Health Care Reform Act (HCRA), we are required to collect the surcharge and to pay it to New York State’s Department of Health. Some insurance carriers will pay the NY State Surcharge on your behalf, but this varies by insurance carrier. If your insurance carrier did not pay this tax or you do not have health care coverage, you are responsible for paying the NY State Surcharge and we are required to pay the collected surcharge to New York State.

Why do I keep getting bills?

Billing statements are sent periodically for charges that you have not yet paid. Once payments have been received in full, billing statements are no longer generated.

I paid when I checked in for my appointment. Why did I get a bill later for additional charges?

When you pay a copay at check-in, this fee may only cover part of what you owe. This is especially true if you get unscheduled services during your visit. For example, your doctor may arrange for additional services (like a blood test or an X-ray) after seeing you, so the actual cost of your visit may be higher. If there are any additional charges, you’ll get a bill for the difference later.

I have insurance, so why am I receiving a bill from Mount Sinai?

You are responsible for paying any costs that your insurance company does not cover, including items like your copay, deductible, and other non-covered charges. Unless prior arrangements were made, you receive a bill after the costs associated with your visit have been processed by your insurance company

The amount you are billed is based on what your insurance communicates to us in an Explanation of Benefits (EOB). If you do not have insurance and believe you cannot afford to pay, consult our financial assistance policy.

I received an Explanation of Benefits (EOB) from my insurer. Why am I also receiving a bill from Mount Sinai?

Your EOB is different from your Mount Sinai bill. Your Explanation of Benefits summarizes the services you received, the associated costs, and how much your insurance carrier paid. You receive a bill from Mount Sinai after costs associated with your visit are processed by your insurance. You are responsible for paying any costs that your insurance company does not cover.

Your health insurer sends the EOB to help you track your expenses and the limits of your plan (e.g., your deductible, your out-of-pocket maximum, etc.).

What is a copay?

A copay (short for copayment) is a fixed amount you pay for a covered health care service. Copays are a form of cost sharing between you and your insurer, and you might have different copay amounts for different services.

What is a deductible?

A deductible is a fixed-dollar amount that you need to pay before your insurer begins to cover your medical services. You normally pay a deductible during a given period of time (your “benefits period”), and afterwards, you usually pay only a copayment or coinsurance for covered services.

What is coinsurance?

Coinsurance is the percentage of costs you pay for covered health care services after meeting your deductible. For example, let’s say your health insurance plan allowed $100 for an office visit and your coinsurance is 15 percent. If you’ve paid your deductible, you will pay 15 percent of $100, or $15. Generally, you will pay coinsurance until meeting your plan’s out-of-pocket maximum.

What is the “NYS Surcharge” I see on my bill?

The “NYS Surcharge” you see on your bill is a tax on the hospital services that you receive. Under New York State’s Health Care Reform Act (HCRA), we are required to collect the surcharge and to pay it to New York State’s Department of Health. Some insurance carriers will pay the NY State Surcharge on your behalf, but this varies by insurance carrier. If your insurance carrier did not pay this tax or you do not have healthcare coverage, you are responsible for paying the NY State Surcharge and we are required to pay the collected Surcharge to the State. If you have questions about your bill, call the phone number on your billing statement.

If you have a question regarding the NY State Surcharge, contact the New York State Department of Health at 518.474.1673 from 9 am - 5 pm, or check the department’s website.

What if I disagree with my balance or the charges on my statement?

We’re happy to speak with you about any billing details or questions you might have. Please contact the phone number listed on your bill to speak with our Customer Service team.

Why am I getting a bill from a physician I never saw?

You may receive bills from physicians you did not see in person if you have certain tests or treatments in the hospital. These bills are for the professional services doctors provided in diagnosing and interpreting test results while you were a patient.

If you were seen by pathologists, cardiologists, anesthesiologists, radiologists, emergency room doctors, or other specialists, they are required to submit separate bills. Please contact the phone number listed on your bill if you have any questions.

Did you receive my payment?

Please allow 3-5 business days for your payment to be posted to the system from when first received. If you have reason to believe your payment has not been posted timely, please contact the phone number listed on your bill.

Why am I receiving multiple bills from Mount Sinai?

When you receive care at Mount Sinai, you may receive more than one bill. For example, if you have a visit with one of our physicians and you also have blood drawn for lab tests, you may receive a bill from your physician and a separate bill from the lab. If you receive care at one of our hospitals or a physician office or clinic located at one of our hospital sites, you may also receive more than one bill: one from the hospital and others from the doctors or specialists who treated you.

The hospital bills for charges related to services, supplies, equipment, or room used during your stay (this is known as the technical or facility bill). The physicians caring for you bill for charges related to their professional services and/or interpretation of tests (this is known as the professional bill).

You are receiving multiple bills because we are required to bill your insurance separately for professional and technical components of your care. Please contact the customer service phone number on your bills if you have any questions.

Paying My Bill

How can I pay my bill?

There are several convenient ways to pay Mount Sinai bills for yourself or someone else—the quickest and easiest is to pay online. You can start by searching your bill type on our patient billing portal for relevant contact information.

Online: To pay online, please look at the billing statement for an account number, Patient Account Access Number (PAAN), or other information you might need to log in. You can pay for yourself or someone else, such as a family member.

By phone: You can call us at the number on your billing statement to pay by phone. During normal business hours, you can speak with a customer service agent. For some of our sites, you can also pay over our 24/7 automated system.

By mail: You can mail in your payment with the payment stub to the appropriate location listed on your bill.

Can I pay a bill without creating an online account?

Yes you may pay a bill without creating an online account. Please visit the link to the online billing portal on your billing statement, and you can use the one-time payment, quick pay, or pay without enrolling option. Your billing statement provides the account information, PAAN number, or other relevant information required to complete payment online.

Online Account

I'm not seeing an option to pay my bill on your Mount Sinai Patient Billing Portal. Why?

For each bill you pay online, make sure to use the online portal listed on your billing statement. Based on where you received services, your bills might be found on different online billing portals.

The Patient Account Access Number (PAAN) can be used to locate your account online only at Mount Sinai Beth Israel, Mount Sinai St. Luke’s, Mount Sinai West, and Mount Sinai Brooklyn. If you received care at one of these locations, you should see this number listed on your billing statements. Make sure to have your PAAN handy when paying your bills online or by phone.

Insurance

How can I find out whether Mount Sinai takes my insurance?

You should contact your doctor’s office directly to confirm whether your insurance is accepted. You can also check Mount Sinai’s “Find a Doctor” feature to find out whether a particular doctor accepts your insurance.

My insurance information or personal information has changed. How can I update you?

If your insurance or personal information is incorrect or not listed on your statement, please call the number listed on your billing statement. For some of our sites, you might also have the option to update your information through an online billing portal.

Why was my secondary insurance plan not billed for my services?

If you have a secondary insurance plan that you feel has not been billed, please contact us at the customer service number on your billing statement to update your insurance information. For some of our sites, you might also have the option to update your information through an online billing portal.

Financial Assistance

If I can't pay my bill, do you offer financial assistance?

Mount Sinai can help patients who have difficulty paying their hospital bills. To learn more about whether you qualify, consult our financial assistance policy.

If you have difficulty paying your physician bill, contact your physician’s office directly to learn about potential financial assistance policies they might have.

What are the requirements to qualify for financial assistance?

To learn more about our financial assistance requirements, consult our financial assistance policy.

I was approved for your financial assistance program in the past, but I need more medical care now. What do I do?

Financial assistance is awarded on a case-by-case basis. To determine whether additional medical care will be covered by our financial assistance policy, please reapply by consulting our financial assistance requirements.

Does Mount Sinai's financial assistance program cover all of Mount Sinai's hospitals and doctors?

Financial assistance may not always be applicable for all professional services. To learn more, consult our financial assistance requirements.

If I apply for financial assistance, is this information made public?

No. All information in your application is kept confidential.